Art News

Art

Experience the Future of Art: Laurence Gartel’s “MIAMI-NORMANDIE” Launch Weekend

Mon Jul 21 2025

MillionairesXchange is proud to spotlight a rare cultural event merging legacy, innovation, and international artistry: the two-day celebration of Laurence Gartel’s “MIAMI-NORMANDIE.” Known globally as the Father of Digital Art, Gartel brings his vibrant genius to France for a landmark exhibition and immersive weekend.

This momentous gathering invites collectors, creatives, and connoisseurs to witness the past, present, and future of art through the lens of a singular visionary—whose impact spans five decades and now converges with AI and robotics.

Saturday, September 13: Celebration and Immersion

The festivities commence with a press conference at Hôtel de Ville Park (3:30 PM)—a rare opportunity to engage directly with Gartel as he reflects on his groundbreaking journey in digital art. Media representatives and VIP guests are invited to an exclusive conversation with the artist.

At 4:30 PM, join Madame Mayor and Laurence Gartel for the official opening of his 50-Year Retrospective. This ribbon-cutting ceremony at Hôtel de Ville Park will unveil a sweeping tribute to Gartel’s legacy—an exploration of digital culture before it became mainstream.

The evening continues at 6:30 PM with the Opening Reception of the AI and Robotics Exhibitions at the Grand Casino Gallery / Domaine de Forges. This visionary showcase highlights the intersection of art and artificial intelligence—featuring never-before-seen works co-created with AI, as well as Gartel’s mesmerizing robotic sculptures. Guests will also have the opportunity to receive a signed copy of his latest book.

Sunday, September 14: Encounters and Innovation

Day two is designed for more intimate engagement and thought-provoking conversation.

Start the morning at 11:00 AM with Coffee and Entertainment in the Park, where guests can mingle casually with Gartel amidst live surprises at Hôtel de Ville Park.

Then, at 12:30 PM, indulge in a private brunch at Domaine de Forges, a refined setting for deeper dialogue and connection.

The afternoon crescendos with the World Premiere of “DIGITAL TITAN” at 2:30 PM in the Ambassadors Hall, Grand Casino—a powerful documentary chronicling Laurence Gartel’s artistic journey and cultural impact.

Finally, at 3:45 PM, witness a live robotics demonstration, followed by a conference on the future of art and technology. Gartel’s robotic creations will take center stage in an interactive performance, concluding with a public roundtable and the official closing of the weekend.

Join Laurence Gartel in Normandy and be part of digital art history.

This weekend is more than an exhibition—it’s a frontier where tradition meets the cutting edge. Whether you're a collector, investor, or innovator, this is an unprecedented opportunity to connect with a living legend and the future of art itself.

For more information and updates, follow the event page on Instagram:

@miami_normandie_

Art

Fine Art Investment Strategies for Wealthy Collectors in 2025

Mon Jun 16 2025

Introduction to Fine Art Investment

Fine art investment represents one of the most sophisticated and culturally enriching

asset classes available to ultra-high-net-worth individuals. Beyond

financial returns, art collecting provides personal satisfaction, cultural

contribution, and legacy building that transcends traditional investment

categories.

The global art market has evolved into a mature financial ecosystem with institutional

infrastructure supporting sophisticated investment strategies. Professional

services including art advisors, conservation specialists, storage

facilities, and insurance providers enable systematic approaches to art

investment that were previously unavailable to private collectors.

Successful art investment requires understanding market dynamics, cultural

trends, and technical expertise spanning multiple disciplines. The

intersection of aesthetic appreciation, historical significance, and

financial analysis creates unique opportunities for collectors who develop

comprehensive knowledge and strategic approaches.

Current Art Market Landscape

The contemporary art market has experienced unprecedented growth, driven by

wealth creation in emerging markets, institutional participation, and

digital platform development. Global art sales exceed $65 billion annually,

with premium segments showing particular strength.

Market Drivers:

Emerging market wealth has created new collector bases with distinct

cultural preferences and purchasing power. Asian collectors have become

dominant forces in impressionist, contemporary, and Asian art

categories.

Institutional participation through art funds, family offices, and museum

acquisitions has provided market stability and professional standards.

Institutional buying creates price floors and market confidence for premium

works.

Digital platforms have democratized market access while maintaining

exclusivity for premium segments. Online sales complement traditional

auction house and dealer channels while expanding global reach.

Market Segmentation:

The ultra-high-end market ($10 million+) remains dominated by masterpiece

works and historically significant pieces. This segment shows consistent

appreciation and limited supply.

The high-end market ($1-10 million) offers diverse opportunities across

periods and styles. Strong demand from emerging collectors drives

appreciation in this segment.

Emerging artist markets provide early investment opportunities but require

sophisticated curatorial knowledge and higher risk tolerance.

Investment Categories and Asset Classes

Blue-Chip Modern and Impressionist Art:

Works by Picasso, Monet, Van Gogh, and other masters represent the most

stable art investment category. These pieces function as "art world

stocks" with established market values and liquidity.

Museum-quality examples command premium prices and show consistent

appreciation. Provenance and condition critically affect values in this

category.

Post-War and Contemporary Art:

Artists like Basquiat, Warhol, Koons, and Hirst represent dynamic market

segments with strong collector demand. Contemporary works often outperform

traditional categories in short-term appreciation.

Market volatility increases with contemporary works, requiring careful

selection and timing. Artist career trajectories significantly impact

values.

Old Master Paintings:

Renaissance and Baroque masters offer historical significance and cultural

importance. Limited supply and museum competition support long-term

values.

Attribution questions and conservation challenges require specialized

expertise. Old Master markets favor exceptional examples in superior

condition.

Emerging and Mid-Career Artists:

Early career investments provide highest return potential but require

curatorial expertise and risk tolerance. Gallery relationships and critical

recognition influence success.

Mid-career artists often provide balance between appreciation potential and

market recognition. These investments require understanding of art world

dynamics and career development.

Alternative Categories:

Photography, prints, and editions offer entry points to blue-chip artists

at lower price points. Limited edition works by major artists provide

accessibility while maintaining quality.

Sculptures and installations require specialized storage and conservation

but often show strong market performance. Three-dimensional works command

attention and demonstrate commitment.

Due Diligence and Authentication

Provenance Research:

Complete ownership history provides authenticity assurance and legal

protection. Gaps in provenance may indicate stolen works or attribution

questions.

Nazi-era provenance requires particular attention due to restitution claims

and ethical considerations. Professional research services verify ownership

history and identify potential issues.

Attribution and Authentication:

Catalogue raisonné inclusion provides strongest authentication for

established artists. Scholar opinions and technical analysis support

attribution claims.

Scientific analysis including X-rays, infrared imaging, and pigment

analysis reveals hidden information and supports authentication.

Professional conservation reports document condition and treatment

history.

Condition Assessment:

Conservation condition directly affects value and future appreciation

potential. Professional condition reports identify issues and estimate

treatment costs.

Environmental damage, previous restorations, and structural problems

significantly impact values. Conservation treatment may enhance or diminish

values depending on quality and appropriateness.

Legal Considerations:

Title verification ensures clear ownership and prevents future legal

challenges. Import/export documentation provides legal compliance for

international transactions.

Insurance coverage protects against loss while providing independent

valuation verification. Specialized art insurance policies cover unique

risks associated with art ownership.

Market Analysis and Valuation Methods

Comparative Market Analysis:

Recent auction results provide market benchmarks for similar works.

Adjustments for size, condition, provenance, and market timing inform

valuation estimates.

Private sale data, though less transparent, often exceeds auction results

and provides additional market intelligence. Dealer relationships provide

access to private market information.

Artist Market Trends:

Career stage analysis considers artist age, gallery representation, museum

exhibitions, and critical recognition. Emerging artists require different

evaluation criteria than established masters.

Market depth and collector base strength affect liquidity and price

stability. Artists with broad collector support show more stable markets

than those dependent on few collectors.

Technical Valuation Factors:

Size, medium, and subject matter significantly impact values within artist

markets. Preferred periods and typical subject matters command premium

prices.

Signature works and museum-quality examples often trade at substantial

premiums to typical examples. Rarity and importance within artist oeuvres

drive exceptional values.

Portfolio Diversification Strategies

Period Diversification:

Balancing modern, contemporary, and historical works provides exposure to

different market cycles and collector preferences. Various periods may

outperform during different economic conditions.

Geographic Diversification:

European, American, and Asian art markets often move independently.

Regional preferences and economic conditions affect market performance

differently.

Medium Diversification:

Paintings, sculptures, works on paper, and photography offer different

investment characteristics. Mixed-media portfolios balance appreciation

potential with storage and conservation requirements.

Price Point Strategy:

Combining blue-chip works with emerging opportunities provides stability

while maintaining growth potential. Budget allocation strategies optimize

risk-adjusted returns.

Storage, Insurance, and Conservation

Climate-Controlled Storage:

Professional art storage facilities provide optimal environmental

conditions, security, and handling expertise. Proper storage prevents

deterioration and maintains values.

Private storage requires sophisticated climate control systems and security

measures. Professional installation and monitoring ensure optimal

conditions.

Insurance Coverage:

Specialized fine art insurance policies cover unique risks including

transit, exhibition, and conservation. Regular appraisals maintain adequate

coverage levels.

International coverage enables global lending and exhibition participation.

Policy terms should accommodate collector lifestyle and exhibition

activities.

Conservation Management:

Preventive conservation maintains artwork condition while preserving

original materials and artist intent. Professional conservation prevents

deterioration and maintains values.

Conservation treatment requires specialist expertise and careful

decision-making. Treatment quality affects values and future conservation

requirements.

Tax Implications and Estate Planning

Acquisition and Ownership:

Purchase tax treatment varies by jurisdiction and intended use.

Professional tax advice optimizes acquisition structures and ongoing

ownership costs.

Charitable Giving:

Museum donations provide significant tax benefits while supporting cultural

institutions. Charitable remainder trusts optimize tax benefits while

maintaining income streams.

Fractional giving strategies enable gradual donations while maintaining

possession and enjoyment. Professional guidance ensures compliance and

optimization.

Estate Planning:

Art valuations for estate tax purposes require qualified appraisers and

careful timing. Estate planning strategies minimize tax burdens while

preserving family collections.

Trust structures provide succession planning while maintaining collection

integrity. Professional estate planning addresses unique art-related

challenges.

Exit Strategies and Liquidity Considerations

Auction Houses:

Major auction houses provide global market access and professional

marketing for premium works. Seller's premiums and timing considerations

require careful planning.

Guarantee arrangements provide price certainty while maintaining upside

potential. Enhanced hammer arrangements optimize sale results for

exceptional works.

Private Sales:

Dealer networks facilitate discrete private sales while maintaining

relationships and market positioning. Private treaty sales through auction

houses combine expertise with discretion.

Long-term Holding:

Patient collectors often achieve superior returns through long-term

appreciation and compound growth. Holding periods of 10+ years typically

optimize investment returns.

Emerging Trends and Future Opportunities

Digital Art and NFTs:

Blockchain-based art creates new investment categories with unique

characteristics. Early adoption provides opportunities but requires

technical understanding and risk tolerance.

Emerging Markets:

African, Latin American, and Southeast Asian art markets offer early

investment opportunities. Cultural appreciation and economic development

drive emerging market growth.

Sustainability and Social Impact:

Environmental consciousness influences collecting preferences and artist

recognition. Sustainable practices and social impact considerations affect

market trends.

Conclusion

Fine art investment combines aesthetic appreciation with financial

opportunity, requiring sophisticated analysis, professional guidance, and

long-term perspective. Success depends on developing expertise, building

relationships, and maintaining strategic focus aligned with personal

interests and financial objectives.

The evolving art market offers compelling opportunities for

ultra-high-net-worth individuals seeking alternative investments providing

cultural enrichment alongside potential financial returns. Professional

advisory services and systematic approaches optimize collection building

while managing risks inherent in this specialized market.

FAQ Section

Q: How much should I allocate to art investment? A: Most advisors recommend 5-15% allocation for alternative

investments including art. Your allocation should align with risk tolerance,

liquidity needs, and personal interest levels.

Q: Should I buy emerging or established artists? A: Balanced approaches often work best. Established artists provide

stability while emerging artists offer growth potential. Your expertise

level should match investment risk.

Q: How do I verify artwork authenticity? A: Use professional authentication services, catalogue

raisonné verification, scientific analysis, and reputable dealers.

Never skip due diligence for expensive pieces.

Q: What are the ongoing costs of art ownership? A: Expect 1-3% annually for insurance, storage, and conservation.

Premium works may require higher maintenance costs but typically justify

expenses through appreciation.

Q: How liquid is the art market? A: Liquidity varies dramatically by artist, price point, and market

conditions. Blue-chip works offer better liquidity than emerging artists or

obscure categories.

Art

Featured Artist: David Milton - Master of Watercolor

Wed Aug 14 2024

Featured Artist: David Milton - Master of Watercolor

David Milton, a master watercolorist, has carved out an impressive career that spans decades, marked by dedication, skill, and a profound artistic vision. Born in New York City on June 19, 1947, Milton's journey into the arts began at the Art Students League in New York. He furthered his education with a Bachelor of Fine Arts from the University of California, Santa Cruz, in 1975, and a Master of Fine Arts from San Jose State University in 1980.

Milton's work is celebrated in some of the most prestigious art circles. He holds signature memberships with the National Watercolor Society, Missouri Watercolor Society, Watercolor West, Taos Society of American Watercolor, and more. His contributions have also earned him a place as a Juried Artist member of the California Art Club, underscoring his influence in the art community.

His watercolors have been showcased in numerous national and international exhibitions, including the Laguna Beach Museum of Art, the Taos Museum of Art, and the Leigh Yawkey Woodson Art Museum. His work has been recognized with awards such as the Watercolor West Jurors Awards and the Dale Meyers Cooper Medal for Watercolor from the Salmagundi Club in New York.

Milton’s art has graced the pages of publications like Watercolor Magazine, Los Angeles Times, and the Splash series of watercolor books. His paintings are part of esteemed collections, including those at 20th Century Fox Motion Pictures, the Bank of America World Headquarters, and the City of Las Vegas Permanent Collection.

Currently based in Laguna Beach, California, David Milton continues to create and inspire. His work remains a powerful testament to the beauty and emotional depth that watercolor can capture, ensuring his place among the greats in contemporary American art.

Explore David Milton's Artwork

Pantages Theater, Hollywood

Frolic Room, Hollywood

Fun City Motel, Las Vegas

California Route 66

Bob's Big Boy

El Coyote, Los Angeles

Blue Swallow Motel, Route 66, New Mexico

Classic Motorcycle

Classic Motorcycle 2

Art

Unveiling the Treasures: Managing Fine Art Inventory in Las Vegas

Thu Dec 14 2023

Welcome to the vibrant world of fine art in Las Vegas, where creativity knows no bounds. In this blog post, we celebrate the rich artistic scene while recognizing the importance of meticulous inventory management for those who treasure valuable artworks.

Fine Art Inventory Management

Efficient Organization of Art Collections

Discover the art of efficient organization for your valuable art collections. From categorizing by artist or style to creating a comprehensive catalog, efficient organization is the first step in preserving the beauty of your fine art.

Cataloging and Documenting for Appraisals

Navigate the art market with confidence through proper cataloging and documentation. Learn how meticulous records aid in appraisals, ensuring a clear understanding of the value and provenance of each piece in your collection.

Preservation Techniques in the Las Vegas Climate

Las Vegas presents unique challenges for art preservation. Explore techniques to safeguard your collection from the desert climate, including proper framing, UV protection, and climate-controlled environments.

Stay tuned for insights into art storage solutions in Las Vegas.

Art Storage Solutions in Las Vegas

Choosing the Right Storage Facilities

Selecting the right storage facility is crucial for the safety of your fine art. Explore considerations such as security, climate control, and accessibility when choosing where to store your valuable pieces.

Climate-Controlled Storage Options

Delve into the benefits of climate-controlled storage options. Understand how maintaining optimal temperature and humidity levels preserves the integrity of delicate artworks, preventing damage and deterioration.

Ensuring the Safety of Valuable Art Collections

Security is paramount. Discover tips and best practices for ensuring the safety of your valuable art collections in storage, including insurance considerations and monitoring systems.

Stay tuned for insights into fine art appraisal and insurance.

Fine Art Appraisal and Insurance

Importance of Regular Appraisals

Regular appraisals are key to understanding the current value of your fine art. Explore the frequency, process, and benefits of appraising your collection to stay informed and properly insured.

Factors to Consider in Fine Art Insurance

Navigate the world of fine art insurance with confidence. Learn about coverage options, considerations for high-value pieces, and how to tailor an insurance policy to suit the unique aspects of your collection.

Maintaining and Increasing Art Value Through Proper Management

Proper inventory management goes beyond preservation—it enhances the value of your art. Uncover strategies for maintaining and increasing the value of your collection through meticulous care and strategic management.

In conclusion, managing fine art in Las Vegas requires a delicate balance of preservation, organization, and strategic planning. Whether you're a seasoned collector or a newcomer to the art scene, this guide equips you with the knowledge needed to safeguard your treasures and enhance their value in the vibrant cityscape of Las Vegas.

Art

Discovering Exquisite Fine Art with MillionairesXchange.com

Thu Nov 09 2023

In the world of fine art, MillionairesXchange.com stands as a unique gateway for art connoisseurs and millionaires alike to explore and acquire exquisite works of art that exemplify beauty, craftsmanship, and elegance. This platform offers a curated selection of fine art pieces that cater to the discerning tastes of the elite. In this guide, we will take you on a journey through MillionairesXchange.com, exploring its offerings, unique features, and how it connects collectors and millionaires with exquisite fine art.

Introduction: The Intersection of Luxury and Art

MillionairesXchange.com represents a harmonious fusion of luxury and art. It caters to a clientele that values the profound beauty, history, and emotion that fine art can convey. This introduction will serve as your entry point to a world where art and affluence coexist.

The Artistic Treasury of MillionairesXchange.com

MillionairesXchange.com boasts a carefully curated collection of fine art pieces that span various genres, styles, and periods. Whether you're a seasoned art collector or a newcomer, this platform has something to offer:

Masterpieces from Renowned Artists

MillionairesXchange.com features works by iconic artists like Leonardo da Vinci, Vincent van Gogh, and Gustav Klimt. These pieces represent the pinnacle of artistic achievement and are available for those who seek to own a piece of art history.

Contemporary Creations

In addition to classic masterpieces, the platform showcases contemporary artists who push the boundaries of creativity. These pieces often reflect current social, cultural, and artistic trends, making them captivating additions to any collection.

Fine Art Auctions

MillionairesXchange.com regularly hosts fine art auctions, providing an opportunity for collectors to acquire exceptional pieces through a competitive bidding process. These auctions are a testament to the platform's commitment to serving art enthusiasts and connoisseurs.

Art Consultation Services

The platform offers art consultation services, connecting buyers with experienced art advisors who can guide them through the acquisition process. Whether you're looking for an iconic masterpiece or a contemporary gem, these advisors provide invaluable insights.

Unique Features of MillionairesXchange.com

MillionairesXchange.com stands out as a platform that caters specifically to the needs and desires of affluent collectors:

Privacy and Discretion

The platform places a strong emphasis on the privacy of its clientele. Millionaires can browse and acquire art in a discreet manner, ensuring their personal and professional lives remain undisturbed.

Art Authentication and Provenance

The authenticity and provenance of each art piece on MillionairesXchange.com are meticulously verified. Buyers can rest assured that they are acquiring genuine works of art.

Customized Art Search

The platform offers customized art search services, allowing collectors to specify their preferences and receive tailored recommendations based on their unique tastes.

Art Investment Opportunities

MillionairesXchange.com provides insights into art investment opportunities, helping collectors make informed decisions about acquiring art as a valuable asset.

Navigating MillionairesXchange.com

To explore the world of exquisite fine art on MillionairesXchange.com, follow these steps:

Browse the Collection:

egin by perusing the platform's collection of fine art. You can filter your search based on artists, styles, or periods to discover pieces that resonate with your preferences.

Consult an Advisor:

If you require guidance, consider engaging an art advisor from MillionairesXchange.com to assist you in your search and acquisition process.

Participate in Auctions:

Keep an eye on upcoming fine art auctions and consider participating to acquire a piece that catches your eye.

Learn About the Artists:

Explore the profiles of the artists featured on the platform to gain a deeper understanding of their work and contributions to the art world.

Maintain Discretion:

If privacy is of utmost importance, use the platform's discreet services to ensure your art acquisition remains confidential.

Conclusion: Where Art and Affluence Converge

MillionairesXchange.com is a sanctuary for those who appreciate the sublime beauty and cultural significance of fine art. It is a place where collectors and millionaires come together to celebrate and acquire masterpieces that embody elegance and sophistication. Whether you're a seasoned collector or a budding enthusiast, MillionairesXchange.com invites you to explore, appreciate, and own the world's most exquisite fine art.

Art

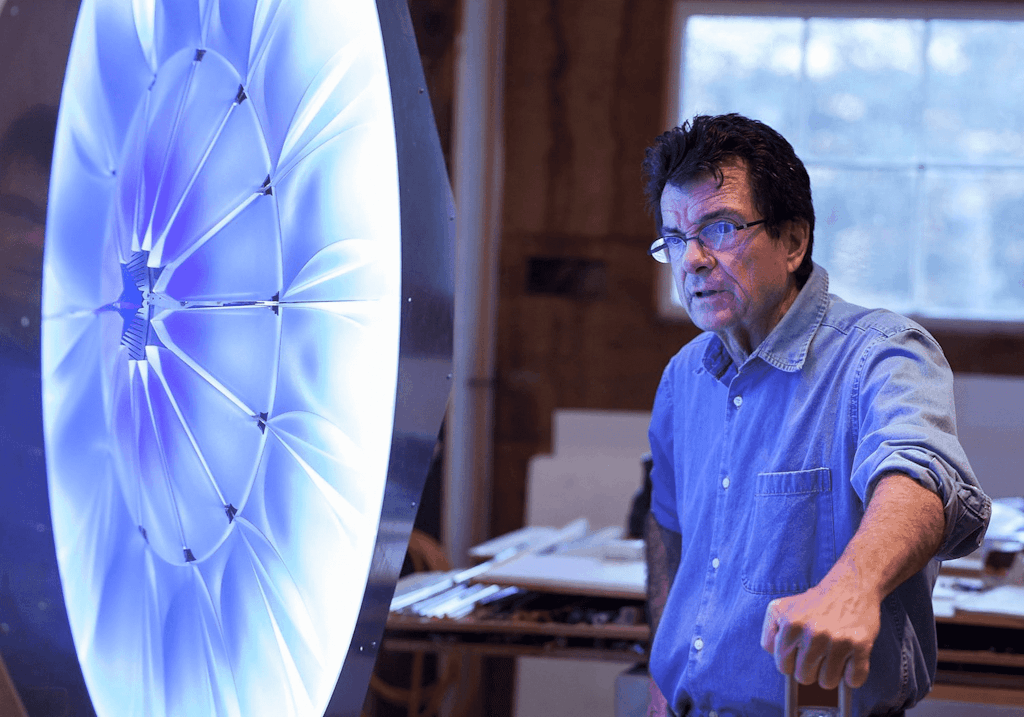

Visit Dan Dailey at LA Art Show 2023

Wed Jan 11 2023

LA Art Show - February 15-19 2023

LA CONVENTION CENTER - WEST HALL

American visual artist Dan Dailey has simultaneously produced sculpture and functional art with an emphasis on lighting

since 1970. Made primarily from glass and metal, every piece of work begins with a drawing. Dailey's drawings and the objects they

inspire depict human character and the world we inhabit, with many familiar forms rendered iconic. His myriad series explore extraordinary concepts with

a broad range of themes and styles. These attributes and his forty years of achievement and recognition have made Dan Dailey a prominent artist in the history of glass, and unique among American artists.

https://www.dandailey.com/

Art

International Artist | Dan Dailey

Mon Nov 01 2021

Our Good Friend and Partner Dan Dailey was recently featured in Schantz Galleries... Read the full article by clicking link below:

https://www.schantzgalleries.com/2021-studio-focus/studio-focus-dan-dailey

About the Artist…

Since 1971, Dailey has participated in over 300 group, juried, and invitational exhibitions,

and has had numerous one-person museum and gallery exhibits including a major retrospective at the

Renwick Gallery of the Smithsonian Institution, and a recent installation at the State Hermitage Museum in

St. Petersburg. He has completed more than 70 architectural commissions for corporate headquarters, hospitals, municipalities,

a county courthouse, a performing arts center, and private residences. His work is represented in more than 50 museum and public collections around the world.