Car News

Cars

Luxury Automotive Investments: Classic Cars and Hypercars for the Elite Collector

Fri Jun 13 2025

Introduction to Automotive Investment

The luxury automotive market

represents one of the most passionate and potentially rewarding alternative

investment sectors for sophisticated collectors. Beyond mere transportation,

investment-grade automobiles embody engineering excellence, design artistry,

and cultural significance that transcends traditional asset classes.

The global collector car market has matured into a sophisticated financial ecosystem supporting

systematic investment approaches. Professional services including

authentication experts, restoration specialists, storage facilities, and

insurance providers enable strategic automotive collecting that combines

passion with profit potential.

Successful automotive investment requires understanding market dynamics,

technical specifications, provenance research, and cultural significance.

The intersection of mechanical engineering, design aesthetics, and

historical importance creates unique opportunities for collectors who

develop comprehensive expertise and strategic vision.

Market Segments and Vehicle Categories

Pre-War Classics (1900-1945):

Early automotive history represents the pinnacle of craftsmanship and

exclusivity. Brands like Duesenberg, Bugatti, and Mercedes-Benz from this

era command exceptional prices due to rarity and historical

significance.

Coachbuilt vehicles from renowned designers like Figoni et Falaschi,

Saoutchik, and Touring provide unique combinations of engineering and

artistry unavailable in modern production.

Post-War Sports Cars (1945-1980):

Ferrari, Porsche, and Jaguar models from this golden era of sports car

development offer strong investment potential with proven track records.

Racing provenance significantly enhances values for competition

vehicles.

Landmark models like Ferrari 250 GTO, Porsche 917, and Jaguar D-Type

represent automotive investment blue chips with museum-quality status and

exceptional appreciation histories.

Modern Classics (1980-2005):

Supercars from this era including Ferrari F40, Porsche 959, and McLaren F1

have transitioned from depreciating assets to appreciating collectibles.

Limited production and technological significance drive values.

Contemporary Hypercars (2005-Present):

Modern hypercars like Bugatti Veyron, McLaren P1, and Ferrari LaFerrari

represent current pinnacle automotive technology with limited production

creating immediate collectibility.

Special Edition and Limited Production:

Manufacturer special editions and limited production runs often provide

strong investment potential when coupled with significant mechanical or

design improvements.

Blue-Chip Classics vs. Modern Hypercars

Classic Car Advantages:

Proven appreciation histories provide investment confidence with decades of

market data supporting valuation models. Blue-chip classics like Ferrari 250

series have demonstrated consistent long-term appreciation.

Historical significance and cultural impact create timeless appeal

transcending automotive trends. These vehicles represent automotive history

and engineering milestones.

Established collector communities and support networks provide market

liquidity and technical expertise. Classic car infrastructure including

restoration specialists and parts suppliers supports ownership.

Modern Hypercar Benefits:

Immediate usability without concerns about wear affecting value. Modern

reliability and safety systems enable regular enjoyment without preservation

concerns.

Warranty coverage and manufacturer support reduce ownership risks and

maintenance uncertainties. Authorized service networks provide professional

maintenance capabilities.

Advanced technology and performance often exceed classic capabilities

significantly. Modern materials and engineering provide capabilities

impossible in earlier eras.

Investment Considerations:

Classic cars require specialized knowledge for condition assessment and

authenticity verification. Market expertise becomes crucial for successful

classic car investment.

Modern hypercars offer transparency in specifications and condition but

face uncertain appreciation potential. Market maturity takes decades to

establish proven investment characteristics.

Authentication and Condition Assessment

Provenance Research:

Complete ownership history provides authenticity assurance and value

verification. Gaps in ownership records may indicate issues requiring

investigation.

Factory records and documentation verify original specifications and

options. Manufacturer heritage departments often provide build sheets and

delivery records for premium marques.

Racing history and notable ownership enhance values significantly.

Celebrity ownership, racing victories, and concours awards create provenance

premiums.

Technical Authentication:

Matching numbers verification ensures original engine, transmission, and

chassis components. Non-matching numbers significantly reduce values for

most collector vehicles.

Factory specifications confirmation prevents modification

misrepresentation. Original components command substantial premiums over

replacement parts.

Professional inspections by marque specialists identify authenticity

concerns and condition issues. Expert knowledge prevents costly mistakes in

acquisition decisions.

Condition Categories:

Concours condition represents pristine restoration or preservation to

factory specifications. These vehicles command maximum values but may

sacrifice originality for perfection.

Excellent original condition preserves factory finish and components while

maintaining functionality. Original paint and interiors often command

premiums over restored examples.

Driver quality provides functionality with some cosmetic imperfections.

These vehicles offer entry points to significant models while retaining

investment potential.

Project cars require substantial restoration investment but may provide

value opportunities for knowledgeable collectors willing to undertake

comprehensive restoration.

Storage and Maintenance Considerations

Climate-Controlled Storage:

Professional storage facilities provide optimal environmental conditions

preventing deterioration and maintaining values. Temperature and humidity

control protects mechanical components and cosmetic elements.

Security systems and professional handling prevent damage and theft.

Specialized automotive storage offers peace of mind for valuable

collections.

Private storage requires sophisticated environmental control and security

systems. Professional installation and monitoring ensure optimal

conditions.

Maintenance Programs:

Regular exercise and maintenance preserve mechanical functionality and

prevent deterioration. Professional maintenance by marque specialists

ensures proper care and preserves values.

Preventive maintenance programs minimize unexpected repairs and maintain

operational readiness. Systematic maintenance schedules preserve investment

value.

Exercise and Usage:

Regular operation prevents mechanical deterioration and maintains

functionality. Stored vehicles require periodic exercise to prevent seal

deterioration and mechanical problems.

Careful usage maintains condition while providing enjoyment. Excessive

mileage may affect values but total preservation eliminates ownership

pleasure.

Market Analysis and Valuation Methods

Auction Results Analysis:

Major auction houses provide transparent market data for comparable

vehicles. Recent sales establish market benchmarks adjusted for condition,

provenance, and specification differences.

Hammer prices plus buyer premiums represent true market values. Reserve and

estimate analysis provides additional market intelligence.

Private Sale Comparisons:

Dealer transactions and private sales often exceed auction results but

provide less market transparency. Professional relationships provide access

to private market intelligence.

Condition Adjustments:

Valuation models must account for condition differences between comparable

vehicles. Restoration costs and rarity affect premium and discount

calculations.

Market Trends Analysis:

Demographic changes affect collector preferences and market demand.

Generational shifts influence which vehicles appreciate and which

stagnate.

Economic conditions influence luxury spending and collector activity.

Market cycles affect timing for optimal acquisition and disposition

decisions.

Insurance and Risk Management

Agreed Value Coverage:

Specialized collector car insurance provides agreed value coverage

protecting against total loss scenarios. Regular appraisals maintain

appropriate coverage levels.

Usage restrictions and storage requirements may apply but provide premium

savings. Limited mileage and secure storage reduce insurance costs.

International Coverage:

Global coverage enables international events and transport. Rally

participation and concours events require specialized coverage

extensions.

Risk Mitigation:

Diversified collections reduce concentration risk while maintaining

collecting focus. Geographic and era diversification balance risk and return

potential.

Professional services including transport, storage, and maintenance reduce

operational risks. Established service provider relationships ensure quality

care.

Tax Implications and Structures

Collector Vehicle Status:

IRS collector vehicle classification provides certain tax advantages while

imposing usage restrictions. Professional guidance ensures compliance with

collector vehicle requirements.

Depreciation Considerations:

Appreciating collector vehicles may not qualify for depreciation deductions

even when used in business activities. Tax treatment varies based on usage

and intent.

Estate Planning:

Collector vehicle valuations for estate purposes require qualified

appraisers familiar with collector markets. Estate planning strategies

address unique automotive asset challenges.

Exit Strategies and Market Liquidity

Auction House Consignment:

Major auction houses provide global exposure and professional marketing for

exceptional vehicles. Seller commissions and timing considerations require

careful planning.

Reserve strategies protect against unfavorable market conditions while

estimates guide bidder expectations.

Dealer Networks:

Specialist dealers provide market access and discrete transaction

capabilities. Established relationships facilitate future acquisitions and

dispositions.

Private Treaty Sales:

Direct collector transactions minimize fees but require market knowledge

and professional assistance for documentation and transfer.

Emerging Trends and Future Opportunities

Electric and Hybrid Supercars:

Early electric supercars like Tesla Roadster and hybrid hypercars may

become collectible as automotive technology milestones. Early adoption

provides potential future rewards.

Younger Collector Demographics:

Millennial and Gen Z collectors prefer different vehicles than traditional

collectors. Japanese supercars, American muscle cars, and 1990s icons gain

popularity.

Digital Documentation:

Blockchain verification and digital documentation provide authenticity

assurance and ownership records. Technology integration enhances collector

confidence.

Conclusion

Ultra-luxury automotive investment combines mechanical passion with

financial opportunity, requiring specialized knowledge, professional

guidance, and strategic approach to vehicle selection and management.

Success depends on understanding market dynamics, technical expertise, and

commitment to proper care and preservation.

The evolving collector car market offers compelling opportunities for

sophisticated collectors seeking alternative investments providing both

driving pleasure and appreciation potential. Professional advisory services

and systematic approaches optimize collection building while managing risks

inherent in this specialized market.

FAQ Section

Q: What's the minimum investment for serious automotive

collecting? A: Entry-level collectible vehicles start around $50,000-100,000, but

significant classics typically require $250,000+ budgets. Modern hypercars

often exceed $500,000-1,000,000.

Q: Should I buy restored or original condition vehicles? A: Original condition vehicles often command premiums, but

restoration quality significantly affects values. Professional assessment

helps determine optimal choice for specific vehicles.

Q: How much does proper storage and maintenance cost? A: Professional storage costs $200-500 monthly per vehicle. Annual

maintenance typically ranges from $2,000-10,000 depending on vehicle

complexity and usage.

Q: Are modern supercars good investments? A: Limited production modern supercars may appreciate, but investment

potential remains unproven compared to established classics. Buy for

enjoyment first, investment second.

Q: How do I authenticate a classic car? A: Use marque specialists, verify matching numbers, research

provenance, and obtain professional inspections. Documentation and expert

knowledge prevent costly mistakes.

Cars

The All New EV Fisker Ocean SUV

Wed Nov 30 2022

The Fisker Ocean is an exciting new all-electric SUV from a startup California automaker that’s reinventing mobility for the 21st century. Created to be superbly designed, innovative, and sustainable, the Fisker Ocean is the first vehicle from a company co-founded by CEO Henrik Fisker, a noted designer and entrepreneur.

“We developed the Fisker Ocean to redefine what’s possible for an affordable EV, emphasizing the use of recycled materials wherever possible,” Henrik Fisker says. “This SUV has numerous unique features, including a 17.1-inch rotating central screen and a Solar Roof that can deliver 2,000 miles of additional, emission-free range every year, as well as California mode, which opens the vehicle’s windows and roof simultaneously to offer a convertible-like experience.”

Cars

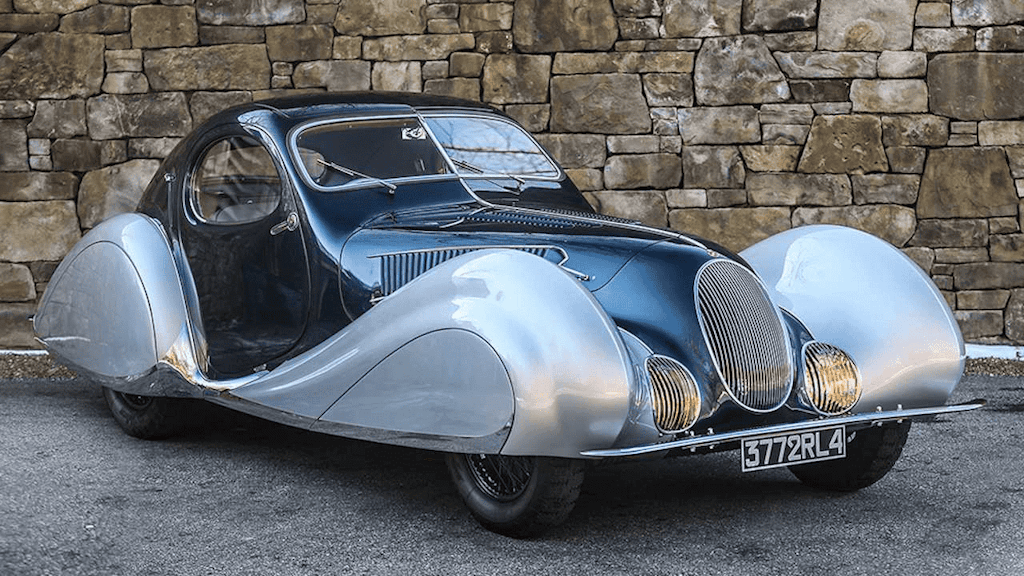

This $13.4 Million Talbot-Lago Is Now the Most Expensive French Car Ever Sold at Auction

Tue Mar 15 2022

The car world was expecting big things from one particular 1937 Talbot-Lago earlier this month, and, well, the vintage ride did not disappoint.

The coveted T150-C-SS Teardrop Coupe in question—chassis No. 90107—sold for a record-breaking $13.4 million at Gooding & Company’s live auction at Florida’s Omni Amelia Island Resort on March 4. Shattering the pre-sale estimate of $10 million, it’s now the most valuable French car ever sold at auction and the most expensive Talbot-Lago in existence.

The high hammer price isn’t a total surprise. For starters, this Goutte d’Eau, or “Teardrop,” variant is one of only a handful to feature bodywork designed and fabricated Figoni et Falaschi. It’s also one of just two to sport elegant all-alloy Modèle New York coachwork, and the only such example with its exterior still intact.

Under the hood, meanwhile, lies a 4.0-liter inline-six engine with overhead valves and three Zenith-Stromberg carburetors that’s capable of churning out about 140 hp at 4,100 rpm. In addition, the coupe is fitted with a Wilson pre-selector gearbox, which allows the driver to “pre-select” the next gear, along with four-wheel mechanical brakes, a front independent suspension and a live rear axle. All of this combined was enough to render the T150-C-SS a real performance car for the time.

Cars

Concours d'Elegance Las Vegas

Thu Oct 28 2021

The MillionairesXchange team were very pleased to Sponsor the Las Vegas Concours d'Elegance this past weekend and a fabulous event it was.

The 2nd Annual Concours to take part in Las Vegas was at the new venue this year - Las Vegas Ballpark and What a Venue!!

Cars

1985 Porsche 930 Turbo 3.3

Wed Sep 01 2021

Introduced in 1975, the Porsche 930 is the first breed of 911 Turbo, at the time the fastest production car in the world and still today one of the most seductive sports cars. This particular example belongs to the second generation of the initial 930 which set in 1978 to feature an engine expansion to a 3.3 litre, an air-to-air intercooler allowing for a greater power output and reduced lag, along with brake units similar to the ones of the legendary 917 sports-racer. The body was also revisted in order to allow for the mechanical upgrades and the rear tail spoiler was slightly raised acquiring the nickname "tea tray" spoiler by enthusiasts.

The renewed Porsche 930 Turbo had a massive success that in fact a considerable amount of units were built. Variating in many colors and combinations it is uncommon to find such a spectacular example finished in Metal Blue paint, fabulously combined with a same Metal Blue leather interior. Manufactured in 1985, it was delivered new to France where it has resided all its lifetime. Acquired by four different owners who strongly preserved it to balance their common use and enjoyment. With 125,000km on the odometer the car features its original leather upholstery and carpet in an absolutely fresh looking condition. It is matching number and accompanied by service book and invoices.

Matching color.

Matching number.

Service book / invoices.

Original leather upholstery and carpet.

Sold new in France (4 French owners).

€ 125,000

Brand: Porsche

Model: 930

Variant: Turbo 3.3

Year: 1985

Exterior Color: Metal Blue

Interior Color: Blue

Gearbox: Manual

Fuel Type: Petrol

Mileage: 125,000 KM

Sold at: Monaco Legend Motors